When people say “LA market,” they’re usually mashing together like 5 completely different markets:

LA County, Orange County, Ventura, Riverside, and San Bernardino.

End of 2025, they’re all doing slightly different things.

Quick TL;DR

No crash. No 2021 mania. Prices are basically flat to slightly up, but inventory is up 35–45% YoY across the 5-county region. That alone is changing the vibe.

Rates dipped into the mid-6s instead of 7s+, which brought a bit of life back into Q4.

Investors are back and heavy, especially in the Inland Empire.

For regular buyers, it’s still painful, but this is the first time in years you have actual choices and some leverage.

County by county – what’s actually happening

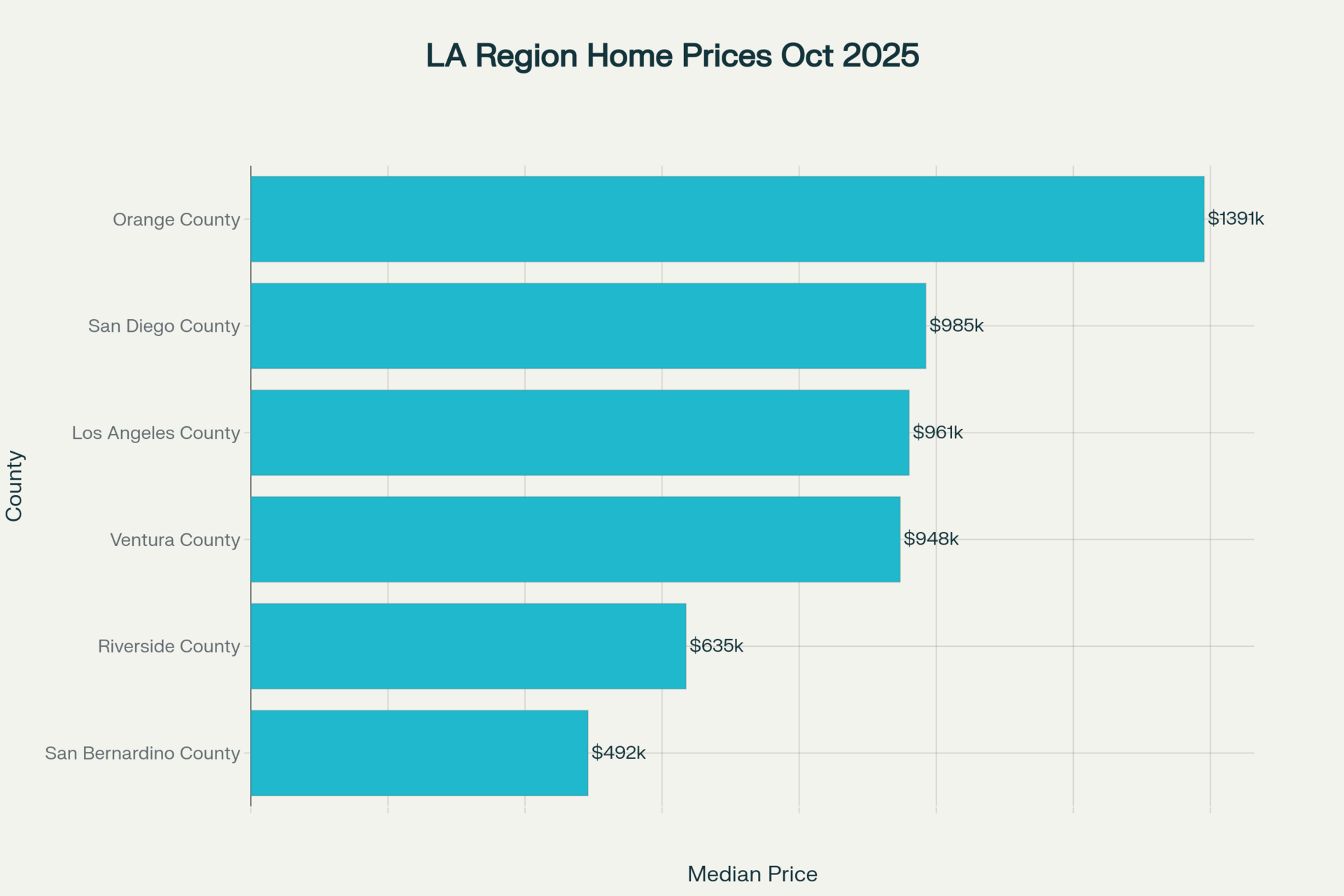

Median Home Prices Across Greater Los Angeles Region Counties (October 2025)

Los Angeles County

Median SFH is hovering right around $1.0–1.05M. YoY price change is basically a rounding error, but:

Days on market pushed into the 40s

The story is submarkets:

SFV and some South Bay pockets are still moving.

Downtown condos and some “aspirational” luxury stuff? Sitting.

Who’s active? A lot of investors and move-up buyers. First-timers are either pushed out to IE or renting.

Orange County

Still the flex kid: $1.3M+ medians are normal now.

Prices are up a couple percent YoY, but:

Inventory is up big.

DOM is mid-30s now, not “sold in 5 days with 20 offers.”

Coastal stuff (Newport, Laguna, CDM) is getting spillover from fire-spooked LA buyers and people done with insurance drama in the hills.

If you’re shopping OC, it’s not “cheap” now, but you’re no longer fighting 20 offers blindfolded.

Ventura County

Kind of the sleeper value play on the coast.

Medians are just under $1M, but that’s still ~lower than a lot of comparable LA coastal stuff.

More space, slower pace, bigger lots, and you’re pulling a lot of remote-work/LA escapee demand.

DOM is higher (40–50 days), so if you can be patient and not fall in love with the first Craftsman you see, there’s room to negotiate.

Riverside County

This is where the numbers actually pencil for a lot of people.

Medians in the mid-$600Ks, inventory north of 4 months, DOM in the 40s.

Investor share is nuts – mid- to high-30% of purchases in some areas.

Rents are still climbing, cap rates are actually cap rates (not 2.8% jokes). For investors doing long-term holds or BRRRR, this is where they’re hunting.