Get the deals in real time. 📲

X: @Dealsletter – live deal threads and underwriting breakdowns.

IG: @Dealsletter – screenshots, charts, and quick deal updates.

TikTok: @Dealsletter – short property tours and before/after vids.

Follow Dealsletter’s founder on X: @KdogBuilds for deal breakdowns and behind‑the‑scenes numbers.

Hello Investors,

🔥 THIS WEEK

KC BRRRR: Get PAID $3,310 to own $205K property producing $126/month

Sacramento 6-Unit: Strong 11.2% CoC ($2,602/mo) with lean 23.6% expenses

North Vegas 5-Unit: Weak 5% CoC needs $30K rehab → 10.3% stabilized

KC Brighton 18-Unit: Beautiful 2020 Class A but terrible 4.4% CoC at $784K down

🔥 Kansas City Bales BRRRR - GET PAID $3,310 TO OWN IT

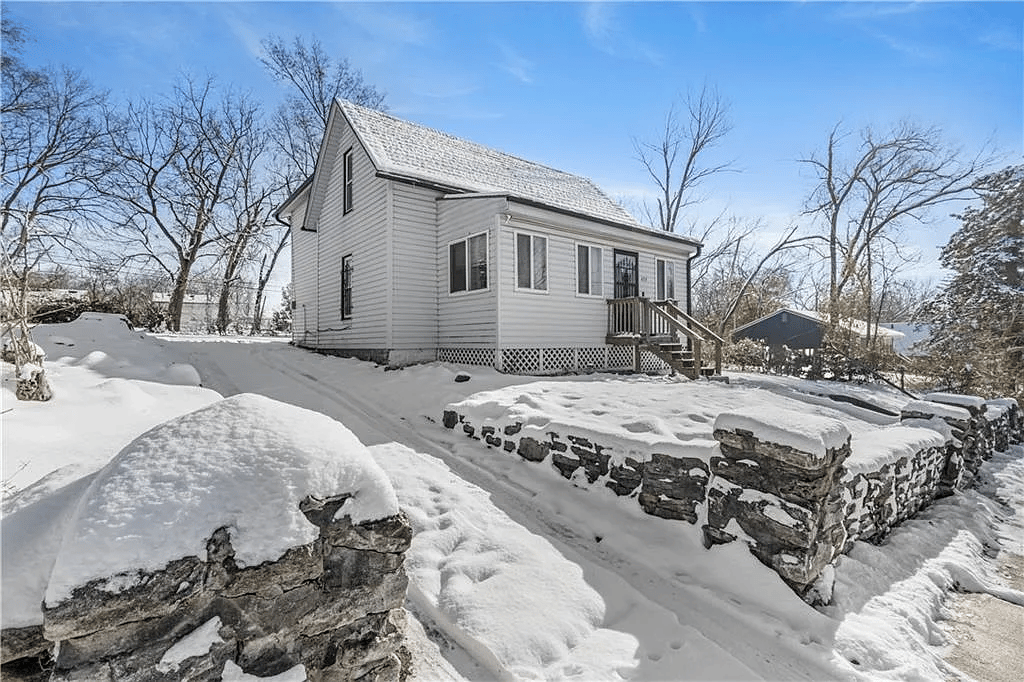

📍 6727 Bales Ave, Kansas City, MO 64132

💰 Purchase: $98,000 | Rehab: $49,500 | ARV: $205,000

🏠 Property: 3BR/2BA, 1,510 SF, Near Swope Park/KC Zoo

🏦 Cash Out at Refi: $20,950 | Net: Get PAID $3,310 | Infinite CoC

BRRRR Mechanics:

Phase 1: Buy & Rehab | |

|---|---|

Purchase Price | $98,000 ($65/SF) |

Hard Money (90%) | $132,800 |

Down Payment (10%) | $14,700 |

Closing Costs | $2,940 |

Rehab Budget | $49,500 ($33/SF) |

Holding (3 months) | $3,807 |

Total Cash In | $17,640 |

Phase 2: Refinance | |

|---|---|

ARV | $205,000 ($136/SF) |

Refinance @ 75% LTV | $153,750 |

New Rate | 6.8% for 30 years |

Pay Off Hard Money | $132,800 |

Cash Out to You | $20,950 ✅ |

Less Initial Investment | $17,640 |

Net Position | -$3,310 🔥 |

Post-Refinance Performance:

Infinite Return Reality | |

|---|---|

Monthly Rent | $1,460 |

Operating Expenses (18.6%) | $258/month |

New Loan Payment | $1,002/month |

Monthly Cash Flow | $126 |

Annual Cash Flow | $1,515 |

Cash Left in Deal | -$3,310 |

Cash-on-Cash Return | INFINITE ∞ |

Forced Equity Creation: $205K ARV minus $98K purchase minus $49.5K rehab = $57,500 instant equity (28% of property value)

30-Year Wealth Trajectory: Year 1 cash flow $1,515 grows to Year 10 $9,796, Year 20 $19,622, Year 30 $34,261 with total profit $1,179,613 - all from NEGATIVE $3,310 initial position

Location Strength: Near Swope Park, KC Zoo, Starlight Theater creating family-friendly demand with easy highway access and strong rental fundamentals

109% ARV Gain: Buying at $65/SF and creating $136/SF value through $33/SF cosmetic rehab demonstrates massive spread enabling full capital extraction

Risk Factors: $49,500 rehab budget tight requiring 10% contingency buffer, must verify $205K ARV with local comps, $1,460 rent needs validation, 3-month timeline critical to minimize $1,156/month interest carry

Recommended Strategy: Textbook BRRRR execution - verify ARV with 3-5 comps, get contractor bids pre-close, pre-qualify for 6.8% refi, target 90-day renovation, repeat with extracted $20,950 cash

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

Sacramento Kenwood 6-Unit - 11.2% COC CASH COW

📍 1705 Kenwood St, Sacramento, CA 95815

💰 Price: $998,000 ($166,333/unit)

🏠 Property: 3 Studios + 3×2BR/1BA, Hagginwood Location

🏦 Year 1 CF: $31,233/yr (11.2% CoC) | Cap: 9.1%

Key Metrics:

Critical Numbers | |

|---|---|

Down Payment (25%) | $249,500 |

Total Cash Required | $279,440 |

Pro Forma NOI | $90,990 |

Year 1 Cash Flow | $31,233 ($2,602/mo) |

Year 1 CoC | 11.2% ✅ |

True Cap Rate | 9.1% |

Expense Ratio | 23.6% ✅✅ |

Debt Coverage | 1.52x |

Ultra-Lean Expense Structure: 23.6% operating costs exceptional due to separate gas/electric meters ($0 utilities), no HOA fees, no landscaping costs, minimal common areas creating institutional-level efficiency at small scale

Pro Forma Rent Reality: $10,450/month ($125,400/year) represents 23% increase over current requiring verification this achievable at market - critical due diligence determining deal viability

Strong Fundamentals: 1.52x debt coverage can absorb 34% income drop, 9.1% cap rare for Sacramento (most 5-7%), 70.1% break-even ratio creates safety margin for economic downturns

10-Year Wealth Building: $2,602/month Year 1 grows to $5,056/month Year 10 (21.7% CoC), cumulative $485K cash flow plus $556K equity buildup = $1,041K total return on $279K investment

Sacramento Market Strength: State capital stable employment, growing tech presence, affordable Bay Area spillover demand, strong schools attract family renters creating durable fundamentals

Value-Add Opportunities: RUBS implementation adds $3,600-5,400/year (infinite ROI), unit renovations $3-5K each generating $100-150/month increases, coin laundry $1,200-2,400/year, storage rentals additional income

Risk Level: MEDIUM - Hagginwood working-class location higher crime, pro forma rents 23% above current requires aggressive verification, $279K capital commitment substantial

Recommended Strategy: CRITICAL - Verify $10,450/month achievable through market comps before proceeding, if current rents significantly lower understand gap timeline, strong buy at verified pro forma