Get the deals in real time. 📲

X: @Dealsletter – live deal threads and underwriting breakdowns.

IG: @Dealsletter – screenshots, charts, and quick deal updates.

TikTok: @Dealsletter – short property tours and before/after vids.

Follow Dealsletter’s founder on X: @KdogBuilds for deal breakdowns and behind‑the‑scenes numbers.

Hello Investors,

HOUSE HACK DOUBLE FEATURE:

Delta St. Duplex – San Diego ($899K)

‣ 5% down ($72K) owner-occupied loan

‣ $3,050/mo housing cost ≈ market rent

‣ $172K instant equity, $519K total in 5 yrs

‣ 2-ADU future development upsideArizona St. Triplex – University Heights ($1.149M)

‣ 5% down ($92K)

‣ $3,851/mo long-term rental cost

‣ $1,751–$2,906/mo with STR strategy

‣ $394K projected 5-yr equity buildOakland 6-Unit ($1.46M)

‣ 67% occupied; fill 2 vacancies → +$5K/mo

‣ CoC improves from 10.3% → ~16–17%Castro Valley 20-Unit ($6.15M)

‣ $1.722M down

‣ 6.9% Year 1 CoC → 15.9% by Year 10

‣ Institutional-grade stability

San Diego Delta Duplex - EQUITY BUILDING AT MARKET RENT

📍 3921-23 Delta St, San Diego, CA 92113

💰 Price: $899,000 | Down: 5% ($44,950)

🏠 Property: Front 3BR/1BA + Rear 2BR/1BA, Fully Renovated, Turnkey

🏦 Your Housing Cost: $3,050/mo | 5-Year Equity: $519,000

House Hack Mechanics:

5% Down Owner-Occupied | |

|---|---|

Purchase Price | $899,000 |

Down Payment (5%) | $44,950 |

Loan @ 6.5% | $854,050 |

Closing Costs | $26,970 |

Total Cash Required | $71,920 |

Monthly Housing Economics | |

|---|---|

True Mortgage Payment | $5,398 |

Front Unit Rental Income | -$3,400 |

Operating Expenses | $1,052 |

Your Net Out-of-Pocket | $3,050 |

Market Rent for 2BR/1BA | $2,500-$3,200 |

Premium for Ownership | $0-$550 |

Instant Equity Position: ARV $1,071,000 minus $899,000 purchase = $172,000 forced equity from day one, total equity position $216,950 (20.3% of property value)

5-Year Wealth Building: Property appreciates to $1,303,000, loan paydown $70,000, appreciation $232,000, total equity $519,000 - effectively built $302K wealth while "paying market rent"

2-ADU Development Potential: Property zoned for 2 additional ADUs at $150-200K each building cost generating $1,800-2,200/month each = $3,600-4,400 total ADU income making housing FREE plus $950/month profit

Exit Strategy Options: (1) Live 2-5 years then rent both units at $5,900 total creating $500/month positive cash flow, (2) Build ADUs Year 2-3 generating $7,400/month total income = FREE housing plus $2,350/month profit, (3) Sell 5-10 years utilizing $250K/$500K capital gains exclusion on $300-500K tax-advantaged profit

Market Rent Reality Check: You're living in 2BR/1BA for $3,050/month (market rate) BUT building equity in $1M+ asset versus renting where $3,050 disappears monthly with zero wealth creation

Risk Level: MEDIUM - $3,050 monthly not cheap requiring income stability, vacancy risk means full $5,398/month burden if tenant leaves, San Diego tax/insurance increases over time, but strong rental market and equity cushion mitigate

Recommended Strategy: Perfect for first-time buyer with $72K saved, planning 3-5+ year San Diego hold, comfortable with market-rate housing cost in exchange for equity building and ADU development optionality

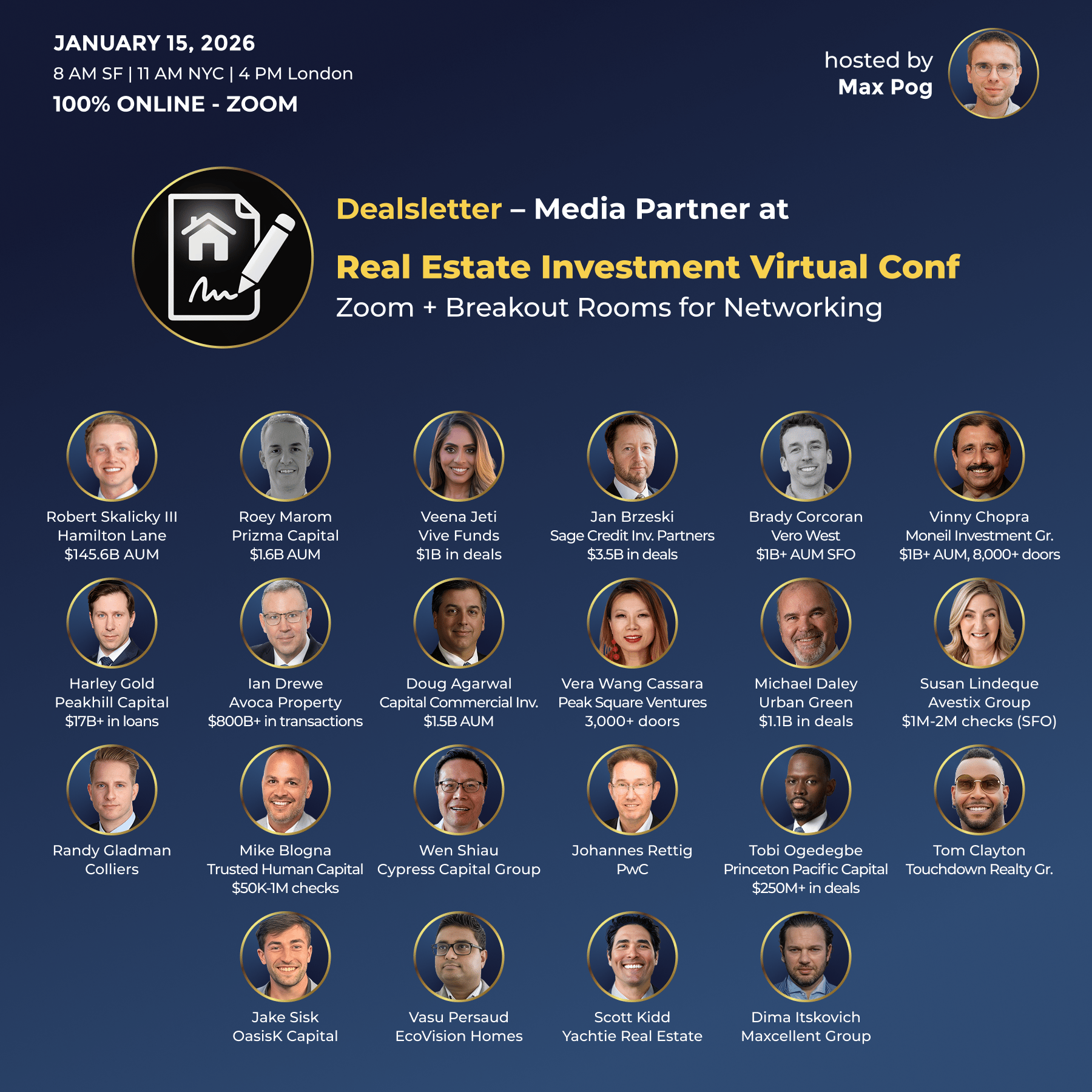

Connect with Hamilton Lane ($145B) & Major FOs on Jan 15

Join the Real Estate Investment Virtual Conf on Jan 15.

It is a Zoom-based event focused on networking with massive capital allocators and dealmakers.

Confirmed speakers/attendees include:

Hamilton Lane ($145.6B AUM)

Avoca Property ($800B+ volume)

Peakhill Capital ($17B+ loans)

Sage Credit ($3.5B deals)

PwC

Vive Funds ($1B+ deals)

Plus other Family Offices, LPs, and GPs.

It is free to join the sessions.

Register here: http://pitchcalls.com/re?51

San Diego Arizona Triplex - STR REDUCES COST 30-50%

📍 4518 Arizona St, San Diego, CA 92116

💰 Price: $1,149,000 | Down: 5% ($57,450)

🏠 Property: Two 3BR/3BA Units, University Heights Premium Location

🏦 LTR Cost: $3,851/mo | STR Cost: $1,751-2,906/mo | 5-Year Equity: $394,000

House Hack Mechanics:

5% Down Owner-Occupied | |

|---|---|

Purchase Price | $1,149,000 |

Down Payment (5%) | $57,450 |

Loan @ 6.5% | $1,091,550 |

Closing Costs | $34,470 |

Total Cash Required | $91,920 |

Monthly Costs | |

|---|---|

Mortgage Payment | $6,901 |

Operating Expenses | $1,150 |

Total Monthly | $8,051 |

Rental Strategy Comparison:

Long-Term Rental Strategy | |

|---|---|

Realistic 3BR/3BA Rent | $4,200/month |

Your Housing Cost | $8,051 - $4,200 |

Net Out-of-Pocket | $3,851/month |

Market Rent Equivalent | $4,000-4,500 |

Savings vs Market | 8% discount |

Short-Term Rental Strategy | |

|---|---|

Conservative STR Performance | |

ADR $300 × 65% occupancy | $5,850 gross |

Less 30% expenses | -$1,755 |

Net STR Income | $4,095/month |

Your Housing Cost | $3,956 |

Realistic STR Performance | |

|---|---|

ADR $350 × 70% occupancy | $7,350 gross |

Less 30% expenses | -$2,205 |

Net STR Income | $5,145/month |

Your Housing Cost | $2,906 ✅ |

Savings vs Market | $1,294/month |

Aggressive STR Performance | |

|---|---|

ADR $400 × 75% occupancy | $9,000 gross |

Less 30% expenses | -$2,700 |

Net STR Income | $6,300/month |

Your Housing Cost | $1,751 ✅✅ |

Savings vs Market | $2,449/month |

University Heights Premium: A+ San Diego neighborhood with walkability, restaurants, culture justifying premium pricing and strong STR demand from tourists and business travelers

STR Execution Requirements: San Diego STR license ($500-1,000), furnish unit well ($8-12K), professional photos ($300-500), dynamic pricing software, either self-manage OR hire at 20-25% fee, maintain 4.8+ star rating

5-Year Wealth Creation: At realistic STR performance saving $15,528/year versus renting, total housing costs paid $174,360 over 5 years, equity position $394,000, net wealth created $128K profit PLUS $78K rent savings = $206K value created

Comparison to Delta Street: Delta $899K creates $3,050/mo cost, Arizona $1,149K creates $3,851/mo LTR cost OR $2,906/mo STR cost - Arizona BETTER with STR due to lower effective housing cost plus same University Heights location premium

3BR/3BA Each Guest Own Bathroom: Premium STR configuration where each bedroom has dedicated bathroom commanding higher nightly rates and better reviews

Risk Level: MEDIUM-HIGH - Requires $92K plus $20K reserves, STR income fluctuation risk, need 5% occupancy buffer, but even conservative LTR strategy works at $3,851 (8% below market)

Recommended Strategy: Execute STR strategy for optimal $2,906 monthly cost (30% below market rent), hold 5+ years building $394K equity while living significantly below market rate, consider ADU development on rear unit for additional income