Get the deals in real time. 📲

X: @Dealsletter – live deal threads and underwriting breakdowns.

IG: @Dealsletter – screenshots, charts, and quick deal updates.

TikTok: @Dealsletter – short property tours and before/after vids.

Follow Dealsletter’s founder on X: @KdogBuilds for deal breakdowns and behind‑the‑scenes numbers.

Hello Investors,

This week is all about turning pricing quirks and distress into better returns. Here is what you’ll see inside:

San Francisco – Mission District 16‑unit mixed‑use: Institutional‑grade location that shows when “prime” pricing caps returns at 2.6% Year 1 CoC, helping you avoid low‑yield premium plays.

Stockton duplex: Unlock positive cash flow at a realistic 30% down, proving how clean underwriting can rescue C‑class cash flow.

Kansas City “Walnut Six” 6‑unit: 91 walk score Midtown asset delivering 5.1% CoC where the location premium is actually justified by streetcar access and urban amenities.

Hayward Hills fire‑damage flip: Large 0.81‑acre lot plus conservative $599/SF ARV vs $744/SF comp builds a $263K safety margin and a projected $153K profit on a realistic $175K remediation budget.

San Francisco Mission 16-Unit

📍 2360-2366 Mission St, San Francisco, CA 94110

💰 Price: $6,000,000 ($375,000/unit)

🏠 Property: 14 Residential + 2 Commercial, 1926 Mixed-Use

🏦 Year 1 CF: $50,659 | CoC: 2.6% | Down: $1,800,000

Key Metrics:

Critical Numbers | |

|---|---|

Down Payment (30%) | $1,800,000 |

Year 1 NOI | $360,980 |

Year 1 Cash Flow | $50,659 ($4,222/mo) |

Year 1 CoC | 2.6% |

True Proforma Cap | 6.0% |

Expense Ratio | 19.8% ✅ |

Year 10 CoC | 8.3% |

Premium Location Problem: Heart of Mission District with BART/Muni access, 65ft Mission Street frontage, vibrant neighborhood creates institutional pricing where $6M valuation reflects appreciation expectations not cash flow fundamentals

Mixed-Use Configuration: 2 commercial units ($8,500/month) plus 12 studios and 1 one-bedroom creates diversified income but 30% down requirement versus 25% residential

Rent Upside Limitation: 14.3% upside ($59K annually) through raising studios from $1,287-2,050 to $2,100 market adds only 0.5% to CoC due to massive capital base

Who This Works For: Institutional investors accepting sub-3% current returns for 4-5% annual San Francisco appreciation and Prop 13 tax protection, NOT individual cash flow investors

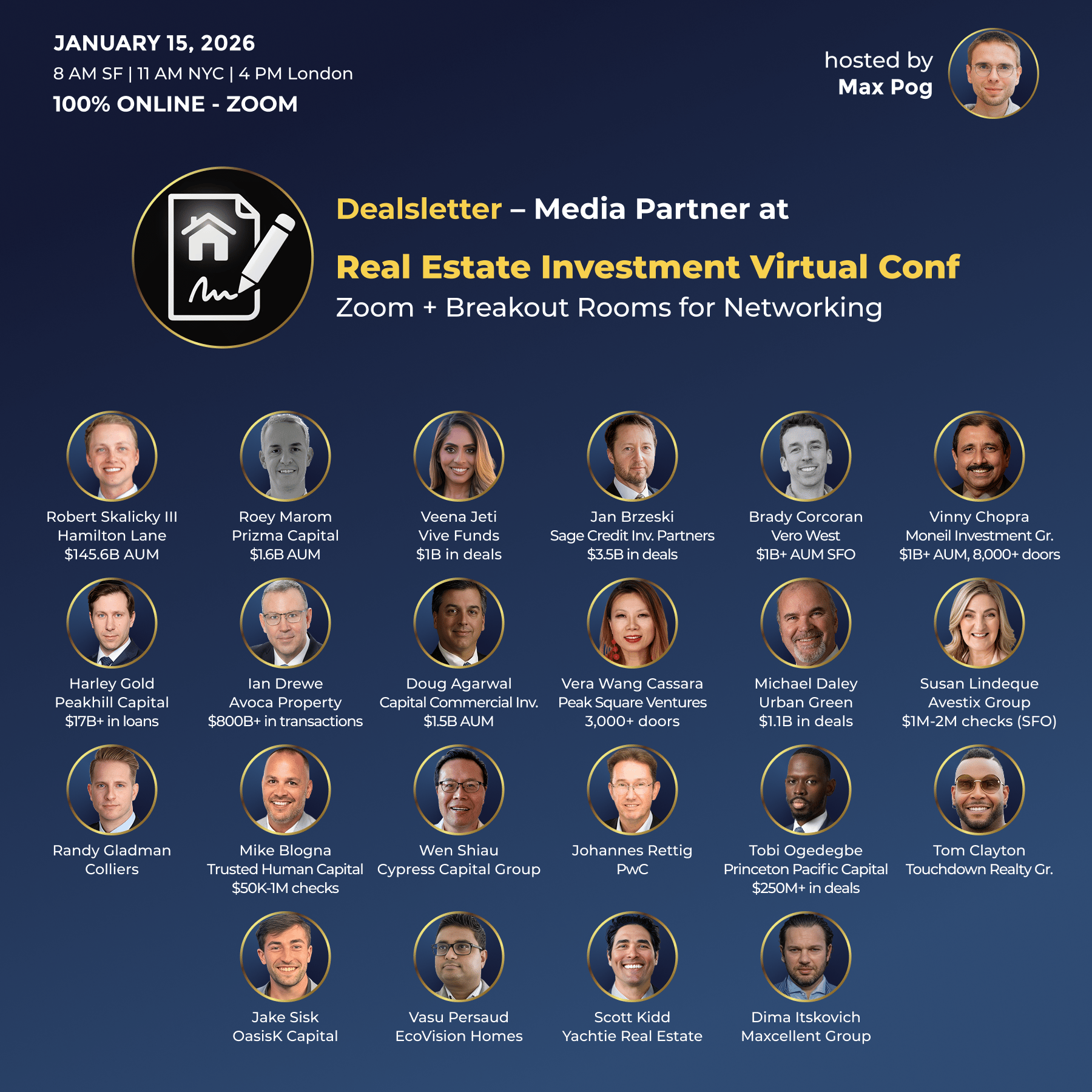

Connect with Hamilton Lane ($145B) & Major FOs on Jan 15

Join the Real Estate Investment Virtual Conf on Jan 15.

It is a Zoom-based event focused on networking with massive capital allocators and dealmakers.

Confirmed speakers/attendees include:

Hamilton Lane ($145.6B AUM)

Avoca Property ($800B+ volume)

Peakhill Capital ($17B+ loans)

Sage Credit ($3.5B deals)

PwC

Vive Funds ($1B+ deals)

Plus other Family Offices, LPs, and GPs.

It is free to join the sessions.

Register here: http://pitchcalls.com/re?51

Stockton Duplex - EXPENSE RATIO REVELATION

📍 7941 Diana Marie Dr, Stockton, CA 95209

💰 Price: $465,000 ($232,500/unit)

🏠 Property: 2 Units (Both 2BR/2BA @ 914SF), Turn-Key

🏦 Year 1 CF: $2,954 | CoC: 2.1% | Down: $139,500 (30%)

Key Metrics:

Critical Numbers | |

|---|---|

Down Payment (30%) | $139,500 |

Year 1 NOI | $28,932 |

Year 1 Cash Flow | $2,954 ($246/mo) |

Year 1 CoC | 2.1% |

Expense Ratio | 18.1% ✅✅ |

True Cap Rate | 6.22% |

With Market Rents CoC | 3.3% |

Expense Ratio Game-Changer: Analysis reveals 18.1% expenses (not initial 26.5% estimate) due to ultra-low $134/month taxes, tenant-paid utilities, no HOA creating efficiency rarely seen even in newer properties

Immediate Positive Cash Flow: $246/month current rents with path to $388/month at market represents stable if unexciting performance requiring 30% down not 25%

Value-Add Math: Light $6K cosmetic updates ($3K/unit paint/flooring) enable $1,700/unit rents creating $5,942 annual cash flow and 4.3% CoC in Year 2

Strong Parking Asset: 2-car garage per unit plus 2 additional spaces each (8 total) rare for duplex and justifies premium tenant quality

5-Year Trajectory: Grows from 2.1% Year 1 to 6.4% Year 5 through organic rent growth, acceptable for conservative stable investor but not growth-focused operator

C-Class Location Reality: Stockton positioning creates limited appreciation upside and modest rent growth versus premium markets but enables low $139,500 entry point

Risk Level: LOW - Turn-key occupied, month-to-month tenants enable immediate rent raises, roof under 10 years, minimal complexity

Recommended Strategy: Counter $435K creating 3.9% current and 5.1% market CoC making patience worthwhile, or pay asking if seeking boring stable mailbox money