🚀 Don’t miss out: Follow Dealsletter on socials for all the latest platform news, and connect with our founder to see the vision behind the properties!

X: @Dealsletter

IG: @Dealsletter

Tiktok: @Dealsletter

Founder(X): @Kdogbuilds

📈 Check out our new property analysis accuracy down below 👇🏼

Welcome to this edition of Dealsletter! We're excited to introduce a new feature: at the end of every newsletter, you'll now find a "Grok-4 Analysis on Accuracy of All Data" section, where we've leveraged Grok-4 from xAI to independently verify and estimate the accuracy of all property details, financials, and market data presented. This ensures the information we deliver is true, reliable, and trustworthy for our readers, because your investment decisions deserve nothing less. Dive in below for the latest deals!

🔎 Our new Deep Dive Analysis

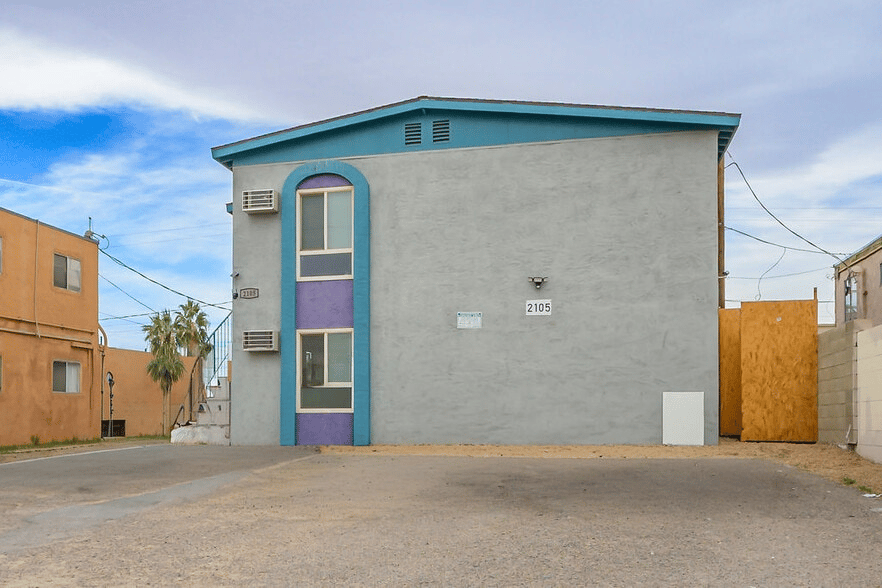

North Las Vegas Webster 4-Unit - 12% COC CASH COW

📍 2105 Webster St, North Las Vegas, NV 89030

💰 Price: $660,839 ($165,210/unit)

🏠 Property: 4 Units (All 2BR/1BA), Fully Renovated, Turnkey

🏦 Year 1 CF: $22,207 | CoC: 12.0% | Cap: 9.3%

Key Metrics:

Critical Numbers | |

|---|---|

Cash Required | $185,000 |

Year 1 NOI | $61,776 |

Year 1 Cash Flow | $22,207 ($1,851/mo) |

Year 1 CoC | 12.0% |

Expense Ratio | 15.3% |

Year 10 CoC | 22.4% |

Turnkey Excellence: Fully renovated with new flooring, bathrooms, main line replacement enabling immediate rent-ready operation

Uniform Configuration: All 2BR/1BA units at $1,600/month simplifying management and maintenance planning

Capital Efficiency: Lowest absolute cash requirement ($185K) among high-performing properties enabling accessible entry point

Strong Fundamentals: 9.3% cap rate with 15.3% expense ratio demonstrates honest seller pricing and sustainable operations

No HOA: Fee-free ownership preserves maximum NOI for investor versus assessments reducing cash flow

Risk Level: LOW - Fully renovated turnkey, uniform units, verified market rents, no surprises expected

Recommended Strategy: Accept asking $660,839 as fair value for returns, verify renovation completion, close immediately

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

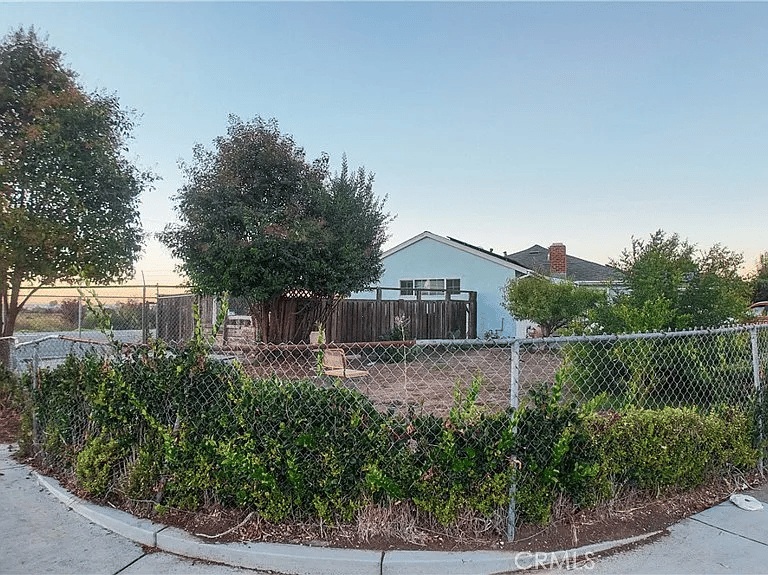

Las Vegas Oakey 5-Unit - RECORD 18.5% COC RETURN 🏆

📍 530 E Oakey Blvd, Las Vegas, NV 89104

💰 Price: $625,000 ($125,000/unit)

🏠 Property: 5 Units (2×3BR/1BA, 2×2BR/1BA, 1 Studio), Downtown/Arts District

🏦 Year 1 CF: $32,387 | CoC: 18.5% | Cap: 11.2%

Key Metrics:

Critical Numbers | |

|---|---|

Cash Required | $175,000 |

Year 1 NOI | $69,810 |

Year 1 Cash Flow | $32,387 ($2,699/mo) |

Year 1 CoC | 18.5% 🏆 |

Expense Ratio | 18.4% |

Year 10 CoC | 31.1% |

Record Performance: Highest cash-on-cash return of all properties analyzed (18.5% versus previous best 12.2% Vallejo)

Configuration: 2 downstairs 3BR units, 2 upstairs 2BR units, 1 side studio unit at $1,500 average rent creating $90K annual gross income

Location Strength: Downtown Las Vegas Arts District with gated security, covered parking, 14 stall capacity

Expense Excellence: 18.4% expense ratio lowest of all multifamily properties demonstrating operational efficiency at small scale

CRITICAL: Verify 5th studio unit legality and permitting - if unpermitted, revert to 4-unit analysis still delivering excellent 10.6% CoC

Risk Level: LOW-MEDIUM - Studio unit permit verification required, but even 4-unit scenario produces strong returns

Recommended Strategy: Offer asking $625K, verify studio permits pre-close, counter $575K if studio unpermitted