Follow Dealsletter for more exclusive deals:

📲 Instagram/Threads: @Dealsletter

📲 X (Twitter): @Dealsletter

📲 TikTok: @Dealsletter

ⓧ Founder: @kdogbuilds

🚀 Beta Launch Coming Soon

We’re getting ready to launch the beta of our investment platform—built to help you find and analyze deals faster than ever.

As a subscriber, you’ll get first access on day one.

👉 Want to stay in the loop during development?

Follow us on X for behind-the-scenes updates, sneak peeks, and live launch alerts.

South San Francisco SRO Hotel - Bay Area Cash Cow

📍 Address: 216-220 Linden Ave, South San Francisco, CA 94080

💰 Price: $6,995,001 ($101,377/unit)

🏢 Property: 69 units (68 SROs + 1 3BR + 2 commercial)

🏦 Cap Rate: 8.23% Current | Optimized: 19% Cash-on-Cash

Why This is a Great Investment:

At just $101k/unit with an 8.23% cap rate in the Bay Area, this SRO hotel offers incredible cash flow with massive optimization potential! Recently renovated in 2022 means no deferred maintenance, while RUBS implementation and vacancy lease-up can push returns to 19% cash-on-cash. This represents institutional returns at mom-and-pop pricing in one of the country's most expensive markets.

Perfect for experienced operators seeking high cash flow with optimization upside.

Current Performance 📝

Investment Metrics (30% Down) | |

|---|---|

Down Payment | $2,098,500 |

Current NOI | $575,928/year |

Current Cash Flow | $168,000/year |

Current Cash-on-Cash | 8.0% |

Optimization Strategy 📝

Value-Add Opportunity | Annual Impact |

|---|---|

RUBS Implementation | +$81,600 |

Lease 17 Vacant Units | +$229,500 |

Self-Management | +$27,600 |

Total NOI Increase | +$338,700 |

Optimized NOI | $784,628 |

New Cash Flow | $397,896 |

New Cash-on-Cash | 19.0% |

Key Success Factors:

Implement RUBS ($100/unit utility charge)

Professional SRO management experience required

Lease vacant units at $1,250/month average

Self-manage initially to maximize returns

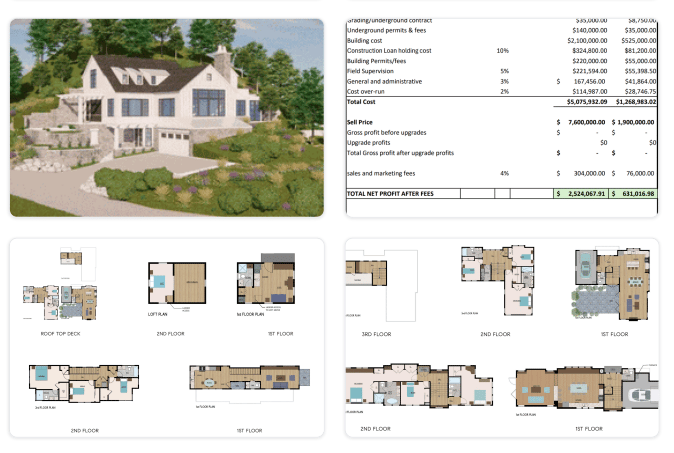

Oakland Temescal Development Syndication

📍 Location: 345-347 51st St & Manila/Coronado Ave, Oakland, CA 94618

💰 Investment: $2,000,000 equity raise

🏗️ Project: 4 detached homes (1,391-2,801 SF)

🏦 Returns: 25.2% to investors | Timeline: 12-14 months

Why This is a Great Investment:

Shovel-ready infill development in Oakland's hottest neighborhood eliminates typical development delays! With permits issued, grading complete, and foundation ready to pour, this project offers development returns with construction-phase risk mitigation. The Temescal/Rockridge border location and experienced developer (285+ projects) provide strong execution probability.

Perfect for investors seeking development returns without development headaches.

Contact: [email protected] OR click the button below!

Investment Structure 📝

Project Economics | |

|---|---|

Total Project Cost | $5,076,000 |

Projected Sale Price | $7,600,000 |

Total Net Profit | $2,524,000 |

Investor Share (20%) | $504,813 |

Investor ROI | 25.2% |

Timeline | 12-14 months |

Project Details 📝

Home | Size | Features | Est. Sale |

|---|---|---|---|

345 51st St | 2,801 SF | 5BR/4BA, rooftop deck | $2,100,000 |

347 51st St | 2,109 SF + ADU | 3BR/2.5BA + 273 SF ADU | $2,000,000 |

5010 Manila | 2,151 SF | 3BR/2.5BA, rooftop deck | $1,850,000 |

4981 Coronado | 1,391 SF | 3BR/1.5BA, entry-level | $1,650,000 |

Risk Mitigation:

Permits issued for 3 of 4 homes

Grading and site work complete

35+ years developer experience

Conservative pricing ($790-850/SF vs $950 market)

San Diego Hillcrest SRO - Comparative Analysis

📍 Address: 3942 8th Ave, San Diego, CA 92103

💰 Price: $4,185,000 ($135,000/unit)

🏢 Property: 31 SRO units (133 SF average)

🏦 Cap Rate: 5.06% Current | Market: 6.78%

Why This is a Great Investment:

Prime Hillcrest location with 31 tiny SRO units offers modest returns but requires intensive management. At $135k/unit for 133 SF rooms, this represents premium pricing for specialized product type. While location is excellent (Walk Score 90+), the management complexity and moderate returns make this suitable only for experienced SRO operators.

Best suited for operators with extensive SRO experience seeking stable but modest returns.

Investment Analysis (40% Down) 📝

Investment Metrics | |

|---|---|

Down Payment | $1,674,000 |

Current NOI | $211,604/year |

Market NOI Potential | $283,756/year |

Monthly Cash Flow | $8,389 |

Cash-on-Cash Return | 6.0% |

SRO Management Considerations 📝

High turnover with 31 small units (133 SF each)

Master-metered utilities ($28,792/year expense)

Shared bathrooms increase management complexity

No HVAC in 1925 building

Tenant screening absolutely critical

Verdict: Reasonable for experienced SRO operators only. The 6% cash-on-cash return is acceptable given prime Hillcrest location, but this is NOT for passive investors.